Table of Contents

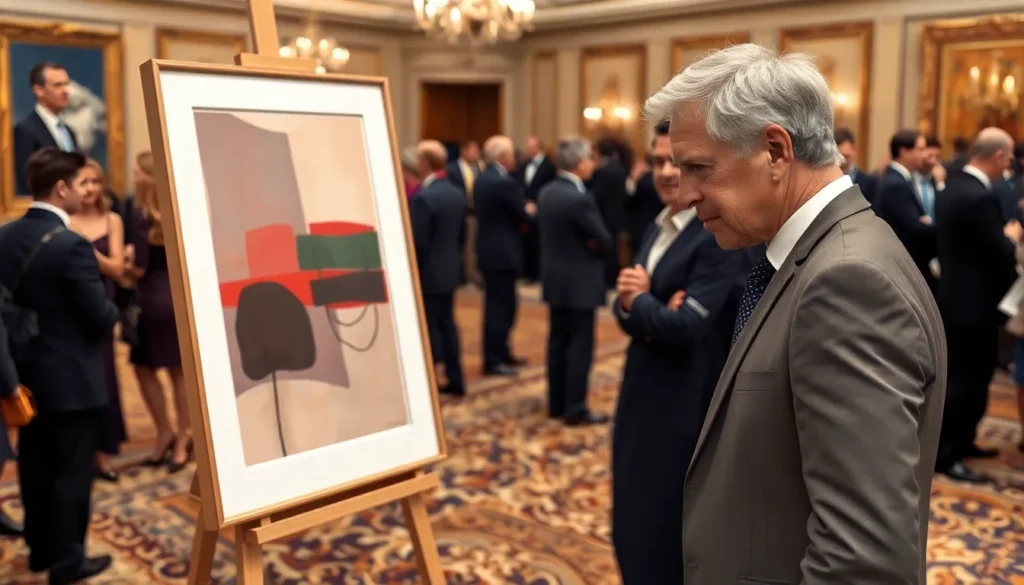

ToggleIn the colorful world of modern art, where splashes of paint and abstract forms reign supreme, a darker side lurks beneath the surface. As galleries showcase bold creations that baffle the average viewer, some savvy individuals have discovered a not-so-innocent way to play the art game: money laundering. Who knew that a canvas splattered with paint could serve as a disguise for illicit cash?

While art enthusiasts admire the genius behind the brush, others are cashing in on the confusion. The intersection of creativity and crime has never been so intriguing. Dive into the murky waters of modern art money laundering, where the lines between legitimate investment and clever disguise blur, and where the art world’s quirks become a playground for the cunning. Get ready to explore how the art scene has become a canvas for questionable financial practices.

Understanding Modern Art Money Laundering

Modern art money laundering involves the use of abstract artworks to conceal illicit funds. Individuals exploit the opaqueness of art valuation, leaving law enforcement and regulators facing challenges.

Definition and Concept

Modern art money laundering refers to the process where individuals use high-value artworks to obscure the origins of illegal money. Artworks often sell for significant sums, allowing offenders to integrate dirty cash into the economy. Valuation can fluctuate wildly due to subjective interpretations, which makes the system vulnerable. Auctions, private sales, and galleries serve as common venues for these transactions, offering anonymity and minimal regulation. As a result, dubious buyers capitalize on the art market’s complexities, creating opportunities for financial misconduct.

Historical Context

The trend of using art for money laundering isn’t new. In the 1970s, cases began to surface as organized crime syndicates turned to the art world for financial concealment. The art market’s lack of transparency makes it an attractive option for laundering activities. Regulatory changes emerged in response, yet loopholes remain in place. Major art fairs and auctions often lack stringent oversight, allowing nefarious practices to persist. Recent scandals highlight the intricacies involved, linking notorious figures to art sales that mask illicit activities. This historical backdrop showcases how modern art continues to evolve as a tool for laundering operations.

The Mechanisms of Money Laundering in the Art World

Modern art money laundering exploits various mechanisms to blend illicit funds into the legitimate economy. One such method involves high-value transactions that make it simple to distort the origins of money.

High-Value Transactions

Many transactions in the art market involve substantial amounts, often reaching millions of dollars. Prices fluctuate based on subjective valuations, allowing criminals to manipulate them easily. Auction houses and private sales can facilitate the purchase of these high-value pieces without transparency. Buyers might exploit this by acquiring artworks at inflated prices, masking illegal money within the transaction. Various payment methods, including wire transfers and cash, further obscure the source of funds. While legitimate collectors invest, the potential for abuse remains evident.

Anonymity in Art Sales

Art transactions often occur behind closed doors, ensuring significant anonymity. Buyers and sellers can remain unidentified, thanks to the private nature of art sales. Galleries and auction houses frequently maintain minimal record-keeping, complicating tracking efforts. As a result, potential criminals find it easy to engage in unlawful practices without scrutiny. Certain jurisdictions even permit nameless transactions, enhancing this atmosphere of secrecy. The lack of stringent regulations fosters an environment where dubious characters can exploit art markets seamlessly. Consequently, anonymity plays a crucial role in facilitating money laundering schemes in the art world.

Case Studies of Notable Incidents

Numerous incidents illustrate the connection between modern art and money laundering. Art transactions often attract scrutiny, revealing hidden complexities in the art market.

Famous Art Transactions Under Scrutiny

Some high-profile transactions have raised concerns, particularly when artworks change hands for astronomical sums. One infamous case involved a sale of a Jeff Koons sculpture for $58.4 million at auction. Investigators suspected that this sale masked illicit financial activities, as the buyer remained anonymous. Another notable incident centered around a piece by Basquiat bought for $110.5 million, drawing attention from authorities and prompting inquiries into the origins of the funds. As buyers manipulate the opaque nature of art valuation, these transactions often serve as a funnel for laundering money. The art world must reckon with the reality that every significant sale could potentially contain underlying fraudulent activity.

Consequences for Artists and Galleries

The repercussions of money laundering extend beyond illicit financial activities. Artists face potential stigma that could damage their reputations if associated with questionable transactions. Galleries inevitably bear liability, as their involvement in opaque sales can lead to loss of trust among collectors and investors. Some institutions have begun implementing stricter due diligence processes to avoid becoming complicit in these practices. However, compliance with regulations often proves challenging given the art market’s inherent anonymity. Legal repercussions can threaten the viability of smaller galleries, as they might not withstand the scrutiny associated with high-value sales. In the end, the consequences ripple through the entire art ecosystem, affecting all who participate in it.

Preventative Measures and Regulations

Efforts to combat money laundering in the art world involve multiple layers of regulation and proactive measures. Governments and authorities play crucial roles in establishing frameworks that enforce compliance.

Role of Governments and Authorities

Regulatory bodies globally are crafting legislation targeting financial crimes in the art sector. Agencies like the Financial Action Task Force provide guidelines to help countries strengthen their regulations. Country-specific laws, such as the UK’s Proceeds of Crime Act and the US’s Bank Secrecy Act, require art dealers to report suspicious activities. These regulations enhance accountability within the art market, holding galleries and auction houses responsible for adhering to transparency standards. Authorities are increasingly scrutinizing high-value transactions to detect potential money laundering. They collaborate with law enforcement agencies to share intelligence, create best practices, and ensure compliance across art markets.

Emerging Best Practices in the Art Market

Art institutions are adopting best practices to safeguard against money laundering. Conducting thorough due diligence has become essential, enabling galleries to verify buyers’ identities and sources of funds. Implementing enhanced Know Your Customer (KYC) protocols allows art dealers to assess risks more effectively. Regular training for staff on recognizing suspicious behavior aims to create a more vigilant environment. Many auction houses now establish clear provenance documentation to trace artworks’ histories. Transparency in pricing and valuation enhances consumer trust while deterring illicit activities. Participating in industry-wide initiatives fosters collaboration between art market participants, assisting in combating money laundering more effectively.

The intricate relationship between modern art and money laundering illustrates a significant challenge within the art world. As high-value transactions continue to attract both legitimate buyers and those with illicit intentions, the need for transparency and accountability becomes paramount.

While regulatory efforts are underway to mitigate these risks, the art market’s inherent anonymity complicates enforcement. Institutions must remain vigilant and proactive in adopting best practices to safeguard against financial misconduct.

Ultimately, addressing these issues is crucial not only for the integrity of the art market but also for preserving the reputations of artists and galleries alike. As awareness grows, the art community can work towards a more transparent and ethical future.